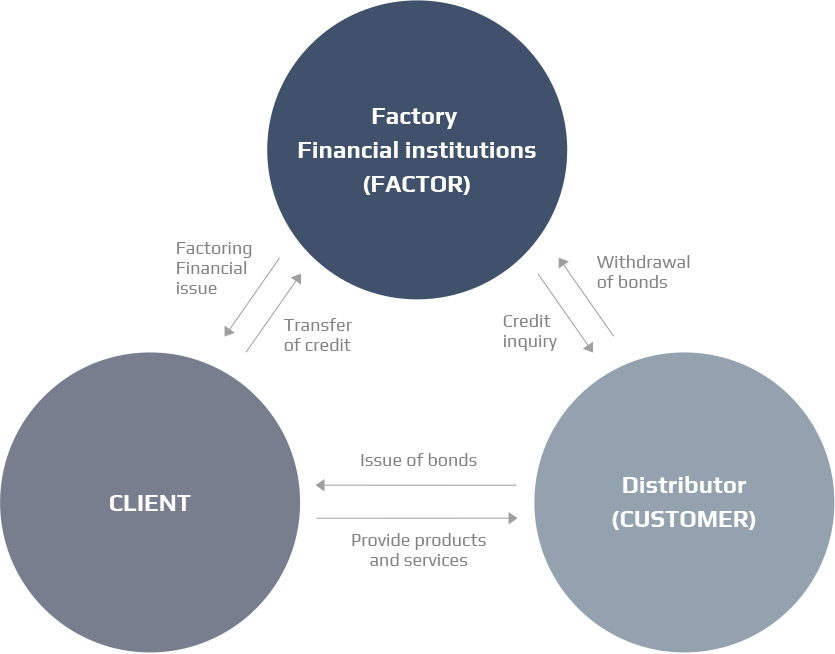

Factoring system

Factoring System for the handling of account receivables

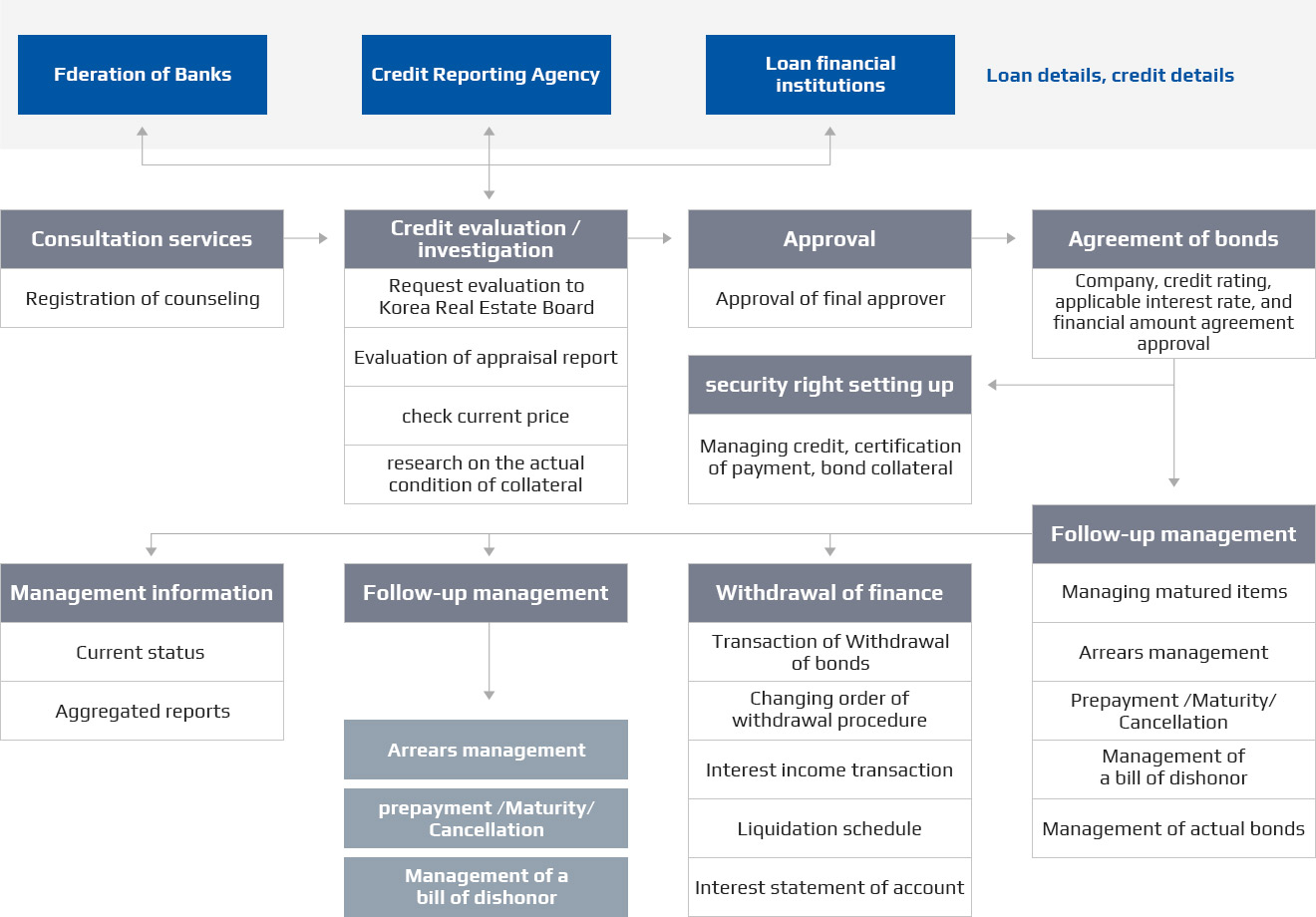

Our Factoring System enables specialized financial organizations to efficiently handle the back office processes required for factoring such as claim assignment, management and recovery.