The Lease Financing System

The Lease Financing System for improving market share and profit

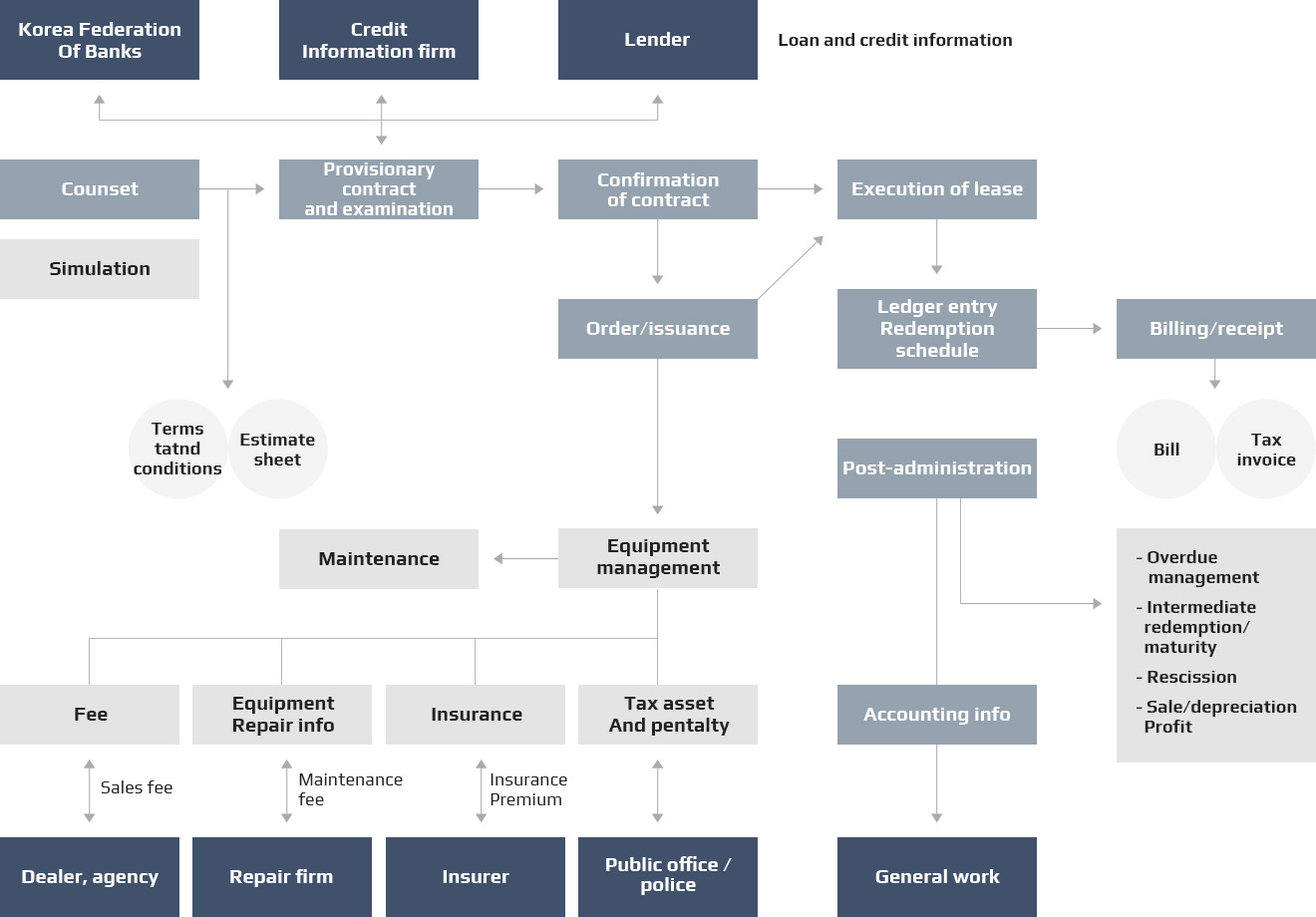

This Lease Financing System, developed by lease financing experts, enables our clients to improve both market share and profit. A less finance gives a firm or a lessee control over an asset, whether it be machinery, equipment, a device or vehicle, for a certain period of time in return for fees. The ownership of the asset is held by the lease company whereas the lessee holds the right to use it The lease is divided into finance Lease and operating lease under the lease accounting standards

Korea’s NO.1 lease finance

-

- Product classification

- Lease in KRW

- Lease in foreign currency

-

- Equipment classification

- General lease

- Heavy machinery lease

- Medical loan(lease)

- Autolease

-

- Classification by accounting principle

- Operating lease

- Finance lease

- Asymmetric Lease

-

- Structural classification

- Joint lease

- Vendor lease

- Supplier lease

-

- Functional classification

- Maintenance lease

- Auto-lease

-

- Classification by currency

-

Plus

- - Client

- - Capital management

- - Accounting

-

Minus

Characteristics and Benefits

Active and Flexible, Advanced Lease Financing System

- Rich experience and advanced modelThis system, built on the management methods of advanced lease finance companies, is used by 13 capital lenders in Korea

- Agile to changes The modification of conditions is easy and rapid adoption in the work process is possible as the system easily accommodates the characteristics of lease finance

- Various examination functions Unique in Korea with the examination function of product model adoption as well as general lease finance examination

- Accommodating all lease processesA foreign currency lease and joint lease system, which gives a comparative, advantage against competitors

- Settlement system This allows complex lease financing to be settled automatically based on the calculation of the daily accumulated balance upon automatic entry into the general journal under the accounting journal system(within 2 hours)

- ABS managementSystem template for the infra-structure system of the securitization of lease assets

- Profit and loss analysisProfit and loss analysis is available by converting the concept of fee- based physical finance to the financial loan

- Application of parametersParameters are established to adopt changes in interest, exchange and yield rates rapidly and flexibly

- Partnership managementThis has functions that handle the processes of our client's partners, suppliers, agencies, associates and mechanics, such as settlement, performance, withholding tax, and limits.