The Loss and Default Information System

The Loss and Default Information System

This show sound loans to the total loan ratio per person and the loss to accumulated sum ratio per person in comparison to factors such as branch, Month, and type of loan. Such analysis data can be useful for HR and credit management in granting the different levels of approval authority.

System Scope

- Increasing sound lending and rewasding employees with good performance

- Granting different levels of approval authority

- Providing bond management information for managerial needs

Objective and accurate individual loss ratio

Major functions and characteristics

Available level of data analysis By utilizing proposal, and account soundness information, the following level of data can be assembled

-

- Employee

- Title

- Branch

- Business Division

- District

-

- Time

- Month

- Average

- Trend

-

- Loan Product

- Product Line

- Product category

- Amount

- Status(depreciated, sold)

- Rollover

- Credit line / individual loan

- Account details

-

- Customer

- Customer category

- Industry category

- Business category

- FLC

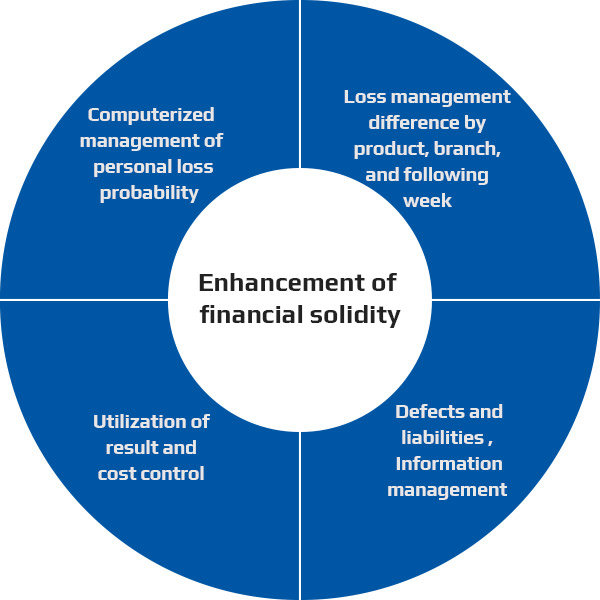

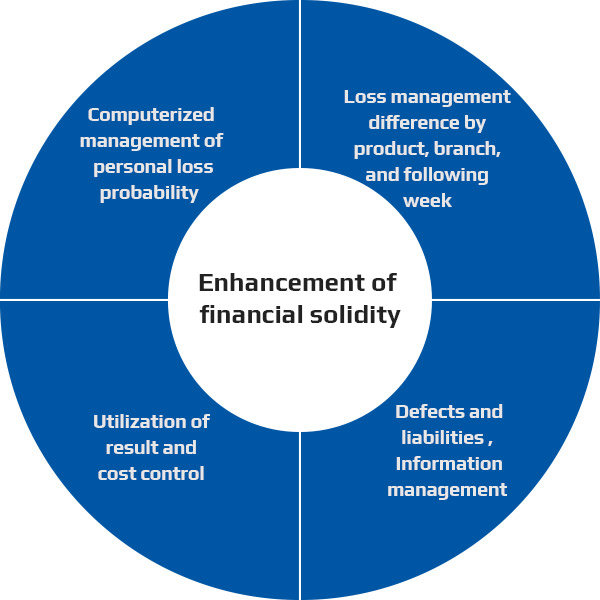

Expected effects and method

| Expected effects |

- As part of measures to enhance asset solidity, employees are aware of dealing with solid loans by computerizing themselves the amount of loss and delinquency rate

- Various information on the loss ratio by product/regional headquarters, products, transactor, and provided monthly for prevention of bad loans.

- Establishment of performance and cost management based on loss handling by individual employees

|

| Application plan |

- Utilize the basis for improving loan system and personnel system by providing various analysis data on transactor, products, type of business, branches ,loss and delinquency rate

- Immediately provide information about a rapidly increasing loss and a delinquency rate of transactors or dealerships to prevent bad loans

-

Provide various information

- Escalating trend of loss and delinquency rate of transactors, products, branches

- Long-term and short-term periods from the date of managing to insolvency Current status of loss and delinquency rate

- The relevant data shall be provided when it is requested by the head of the relevant department

|