Audit Information System

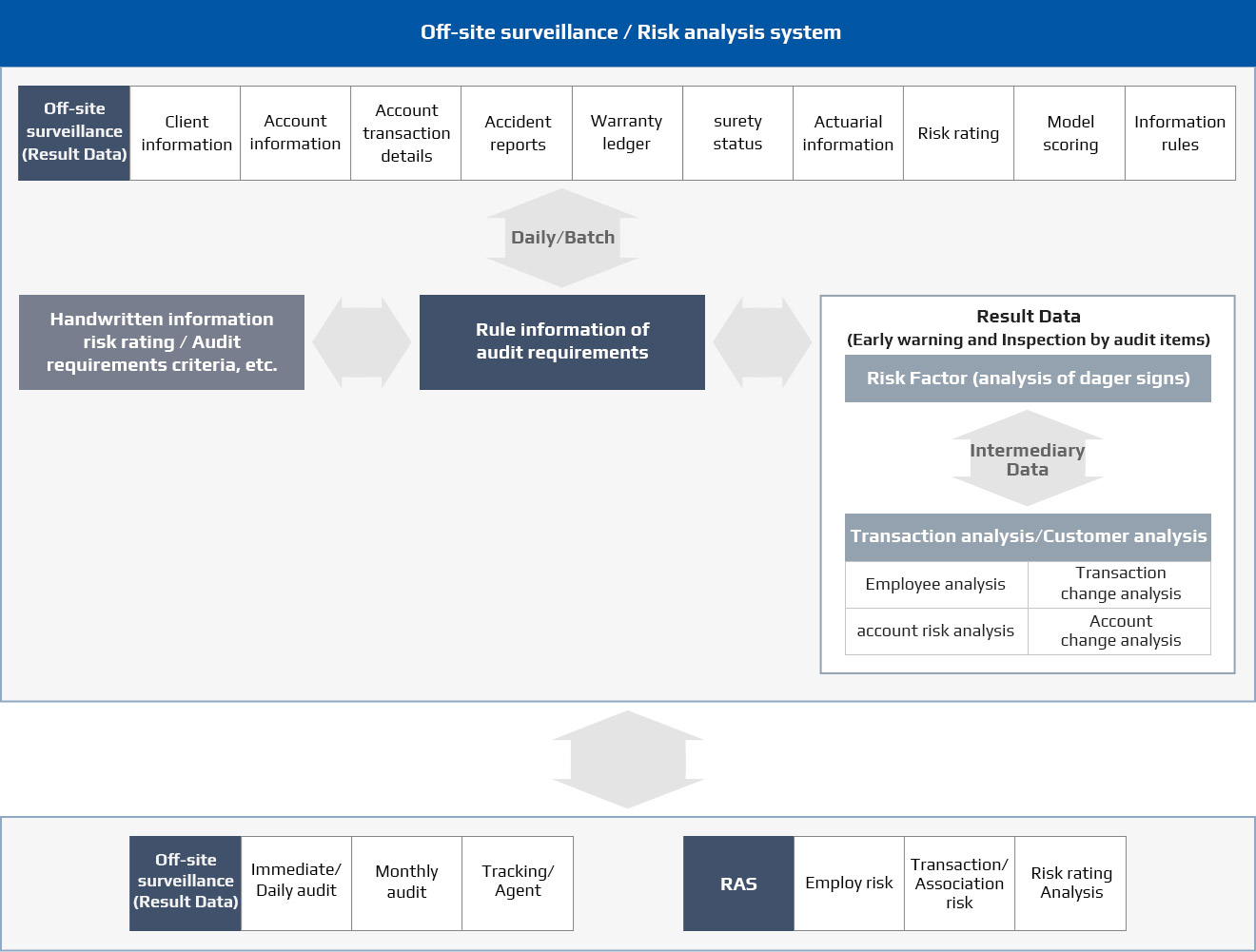

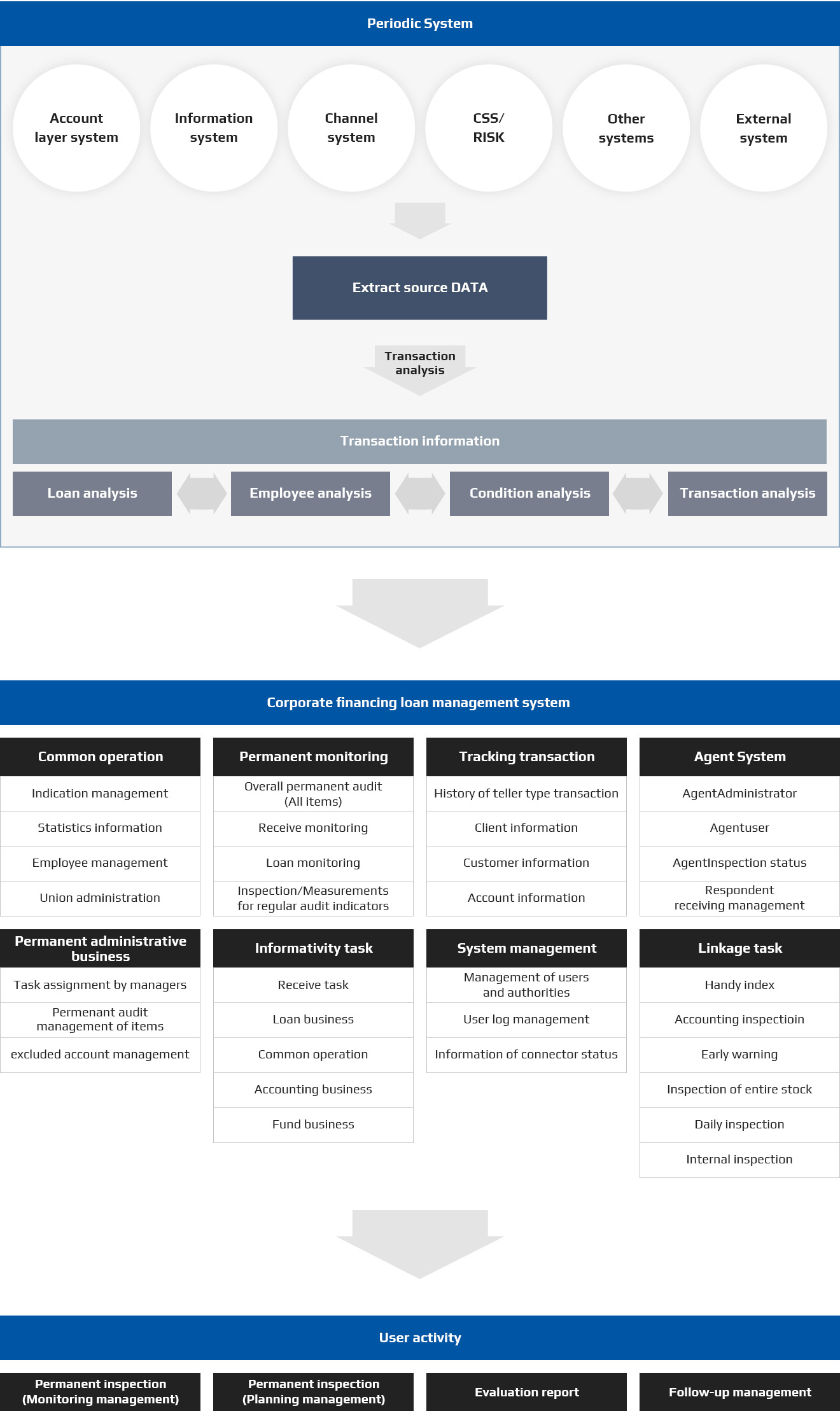

Information system audit contains monitoring system for risky transactions in real-time

The audit system allows you to analyze each type of transaction at a branch office and monitor risky transactions in real-time through data extraction of transaction and classification by risk level.

Characteristics of the IBK System Audit Information System

- Systematize audit requirements and audit items to perform the function itself

- Systematize progressing process and risk measurement to effectively identify abnormal symptoms and accident details

- Automation of integrated permanent process of searching, tracking, analysis, 보치, administration during the audit

Purpose of Audit System

- Financial accident prevention

- Information of inspection and increase value

- Competitive advantage with other institutions

Unify and streamline audit organization

Providing statistical analysis information and conducting audits to suit the characteristics of the combination

Introducing advanced audit techniques efficiently by establishing a web environment and strengthening internal control by establishing an early warning system by computerized system

Scalable, Flexible Audit/Risk Analysis System

Interface

- Receive information

- Loan information

- Personnel information

- Accounting information

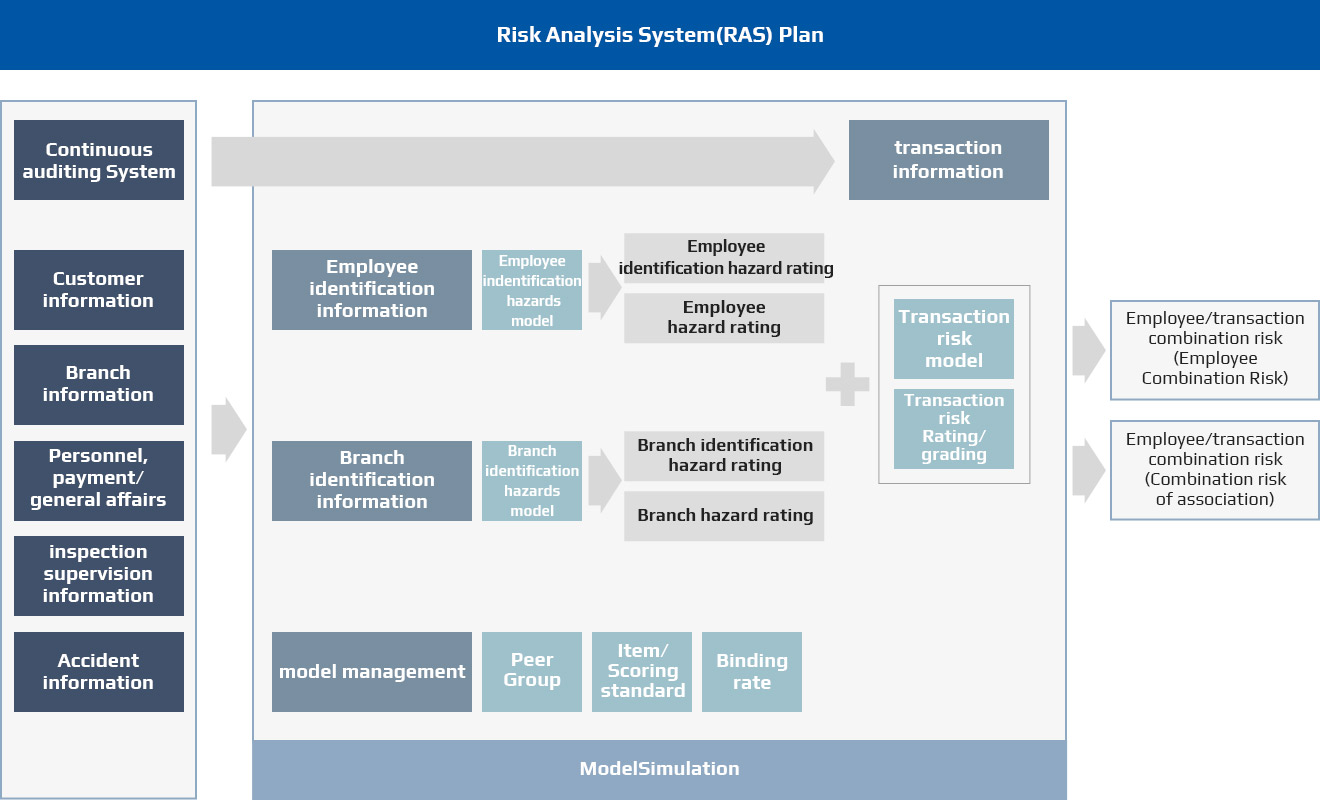

Risk Analysis System(RAS)

Risk analysis system classifies the degree of risks and establishes a model that measures the risk of the brach offices and employees. In addition, by establishing a model to measure risk by transaction (risk transaction of permanent audits), the system measures and manages "combined risks" combining employee and branch risk and transaction risk to provide basic data for testing and support policy establishment.