Overseas Computerized System

Integrated Overseas Computerized System

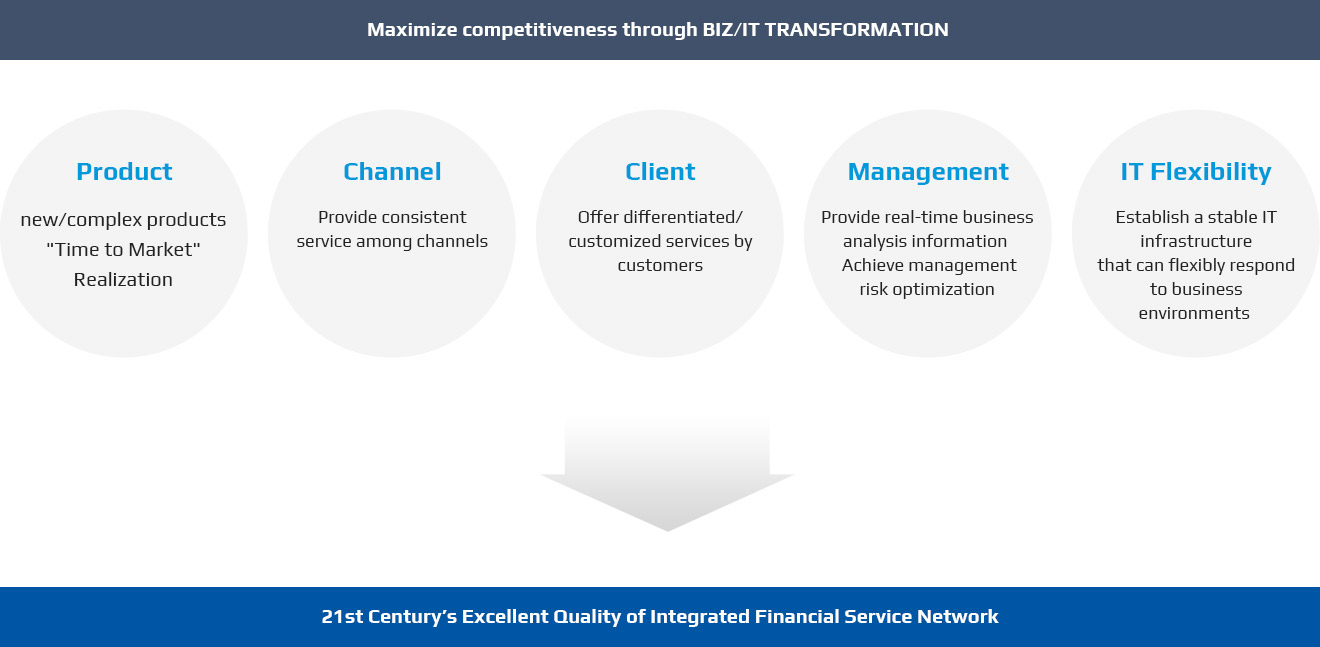

It is an efficient system for developing new products and actively responding to the changes in the financial environment, such as improving customer service at overseas branches, integrated management of overseas branches, and establishing a regional headquarters system.

-

- External environment change

- Increase customer demand for complex/customized financial services

- Demand for changes in the financial environment

-

- Internal environment change

- Strengthen competitiveness by expanding complex financial channels and developing new products

- Providing differentiated financial services through integrated customer information management

- Integrated management of overseas branch information

- Establishing a regional headquarters system

Architecture plan

Integrated plan for terminal architecture Architectural configuration of X-Internet-based web terminal solutions.

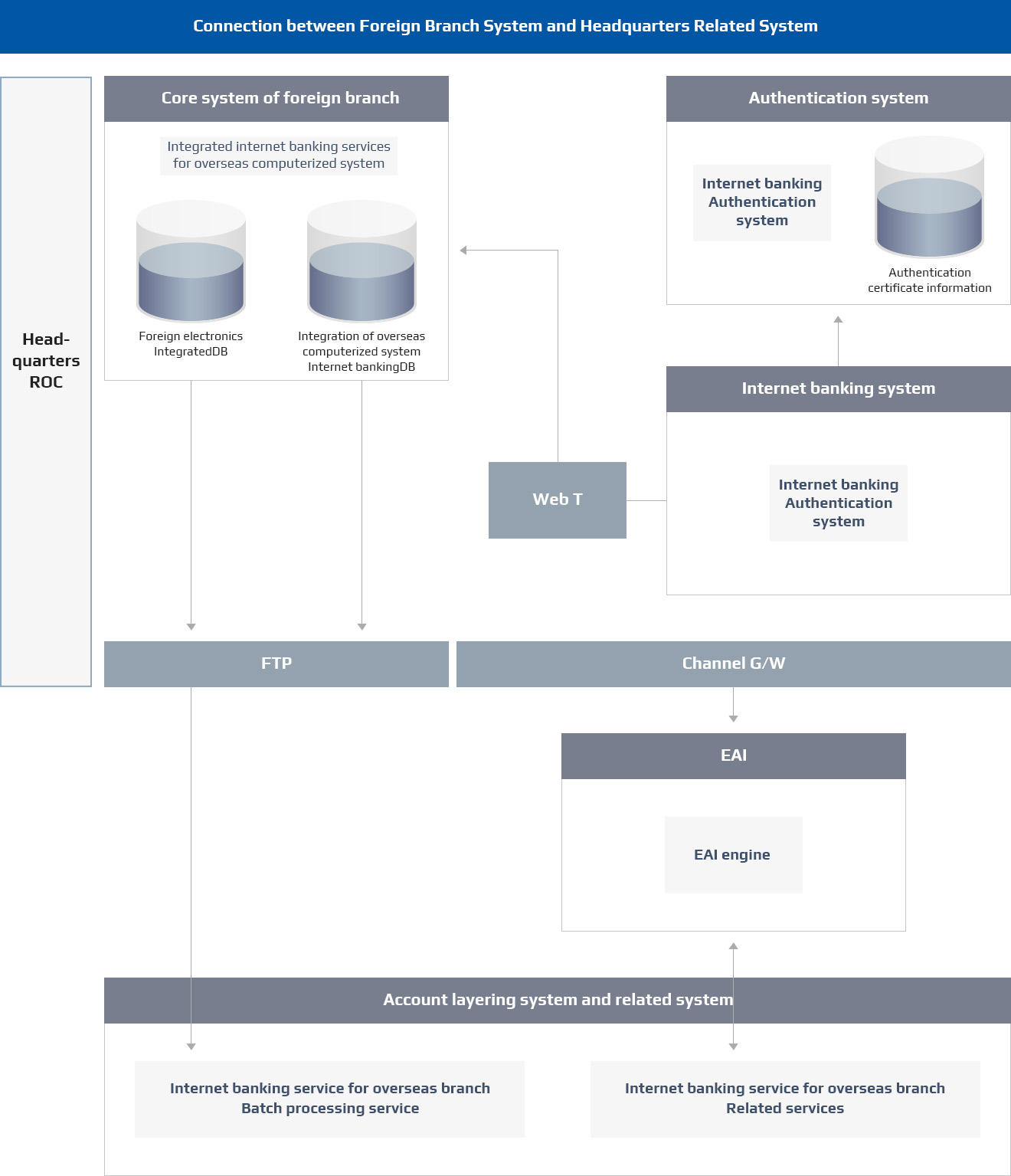

Interface composition

The overseas branch core system is linked through Tmax's WebT, and the headquarters accounting system and related servers are linked using EAI.

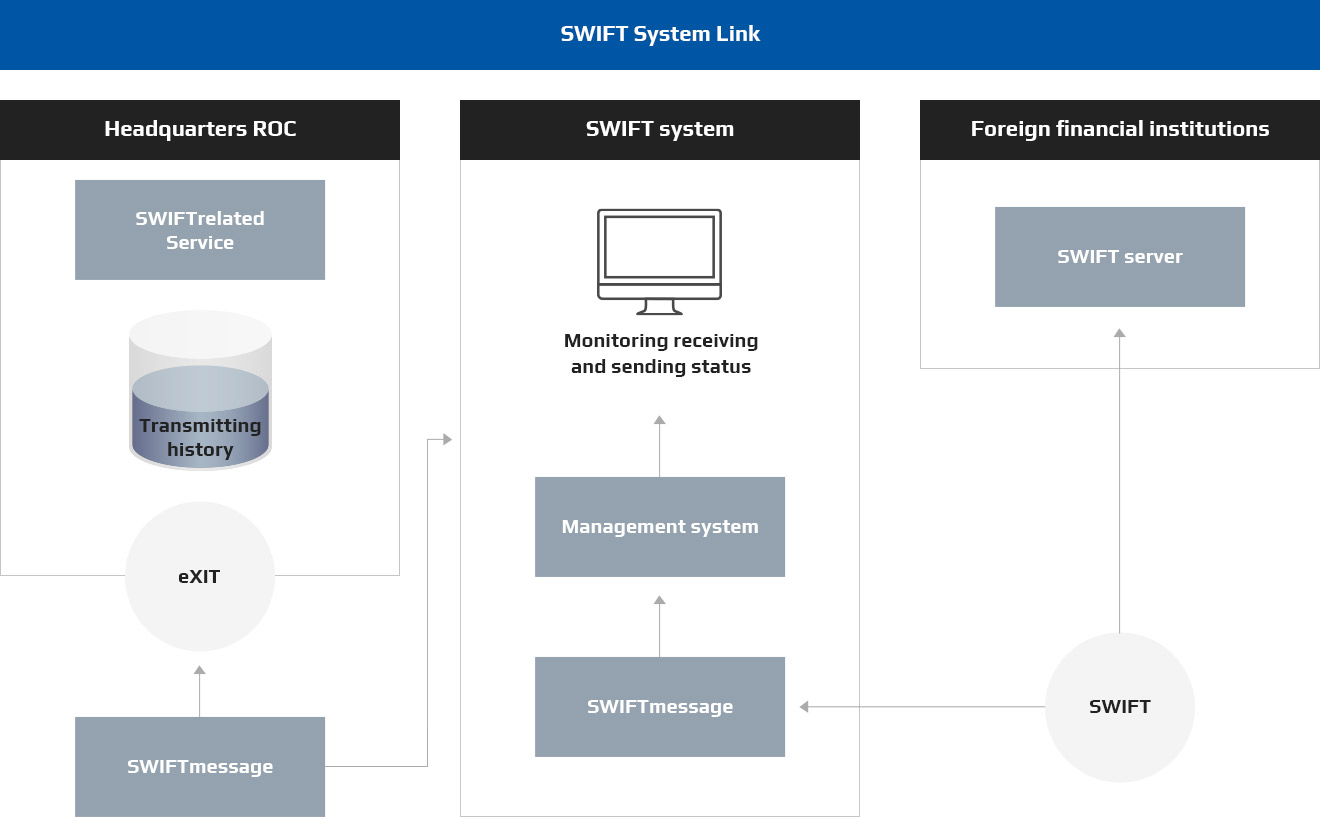

SWIFT System Link

Swift system linkage configuration sends and receives data with the main SWIFT server through the XIT Client installed for each ROC.

Linkage Composition of Terminal Devices and Peripherals

Terminal solution EWC for overseas computerized integration systems provides standard interfaces for devices frequently used by financial institutions, providing scalability and flexibility for a new equipment

terminal enviornment of overseas branch

UI reception

UI loans

UI installment

UI foreign currency

UI finance

UI report

Common Administrator I/F

Standard-based Data Exchange

Control Component of Integrated Financial Device

- Passbook printer driver

- MSR/W driver

- Fingerprint recognition device driver

- Pinpad driver

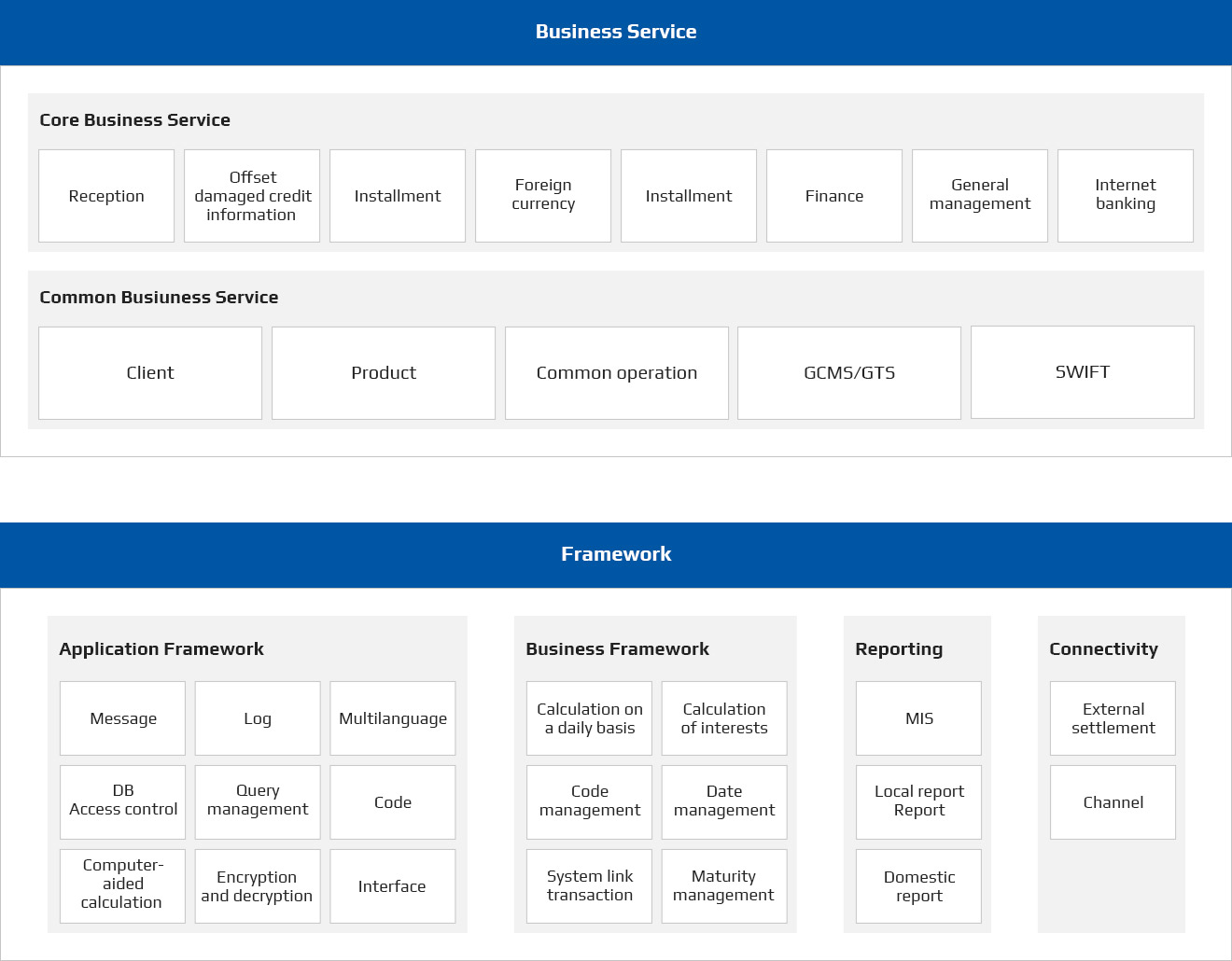

Key function of operating details (Core Business Service)

-

- Reception

- Deposit/payment management

- Passbook/receipt/list

- Monthly management

- Cash management (teller)

- General management

- Banker’s Check/Temporary deposits

- Restricted account registration

- Exchanging check

-

- Offset damaged credit information

- New

- Account management

- Check

- Collateral management

- Follow-up management

-

- Fund

- Common

- Derivative

- Money Market

- F/X

- Securities

- head office and branch management

-

- Foreign currency

- Common

- Export

- Remittance and exchange

- revenues

- Reimbursement/Bill Discount

-

- Installment

- head office and branch

- Balance management

- Settlement of accounts

- Others

-

- Finance

- Common

- General ledger

- Offline

- Money order

- Local daily trial

- STATEMENT

- Position management

- IFRS account settlement of accounts

-

- General management

- suspense receipts management

- suspense payment management

- Clearing Account

- Fixed asset management

- Payment/personnel management

- Managing important documents

- Annual installmenttaxes Withheld

Key function of operating details (Common Business Service)

-

- Client

- Registration

- Creditor

- Information

- Check

- *Information:Limit management by clients, Management of prime exchange Rate and fee waiver

-

- Product

- Common

- Create product information

- Conditon management

- item management

- *Common : Information of product bases, properties, conditions, History of change

-

- Report

- General information

- Business information

- Local reports

- Domestic reports

-

- Common operation

- Holiday management

- Date management

- System management

- User/Menu administration

- Rate of exchange and interest administration

- Transfer

- Term & Condition management

- management of Information of tax rate

-

- GCMS/GTS

- GCMS

- GTS

-

*GCMS :

Account registration management, Integrated inquiries of domestic and foreign accounts, GCMS notification services

*GTS :

Real-time deposit and withdrawal transactions between domestic and foreign branch accounts

-

- SWIFT

- Specialized management on sending

- Specialized management on receiving