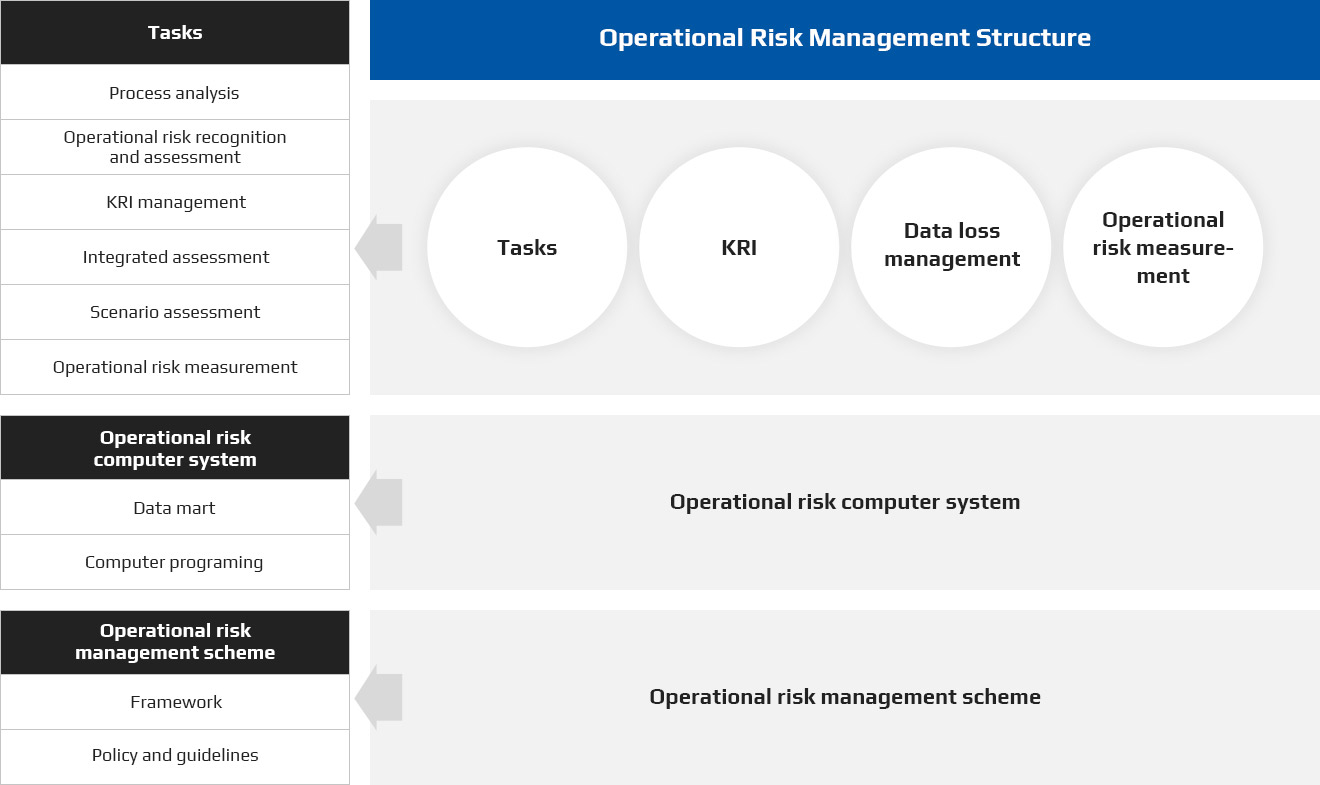

The Operational Risk Management System

Banks are exposed to operational risks stemming from newly-emerged inappropriate internal practices as well as human, systemics and external loss risks as they are required to handle more diverse and complex process in an age of the increasing complexity of financial information technology as well as financial deregulation and globalization. Our operational risk management system, a standardized, extensible and flexible solution, built for and run by Korea’s prestigious financial institutions, allows the management and measurement of RCSA, KRI and loss data.

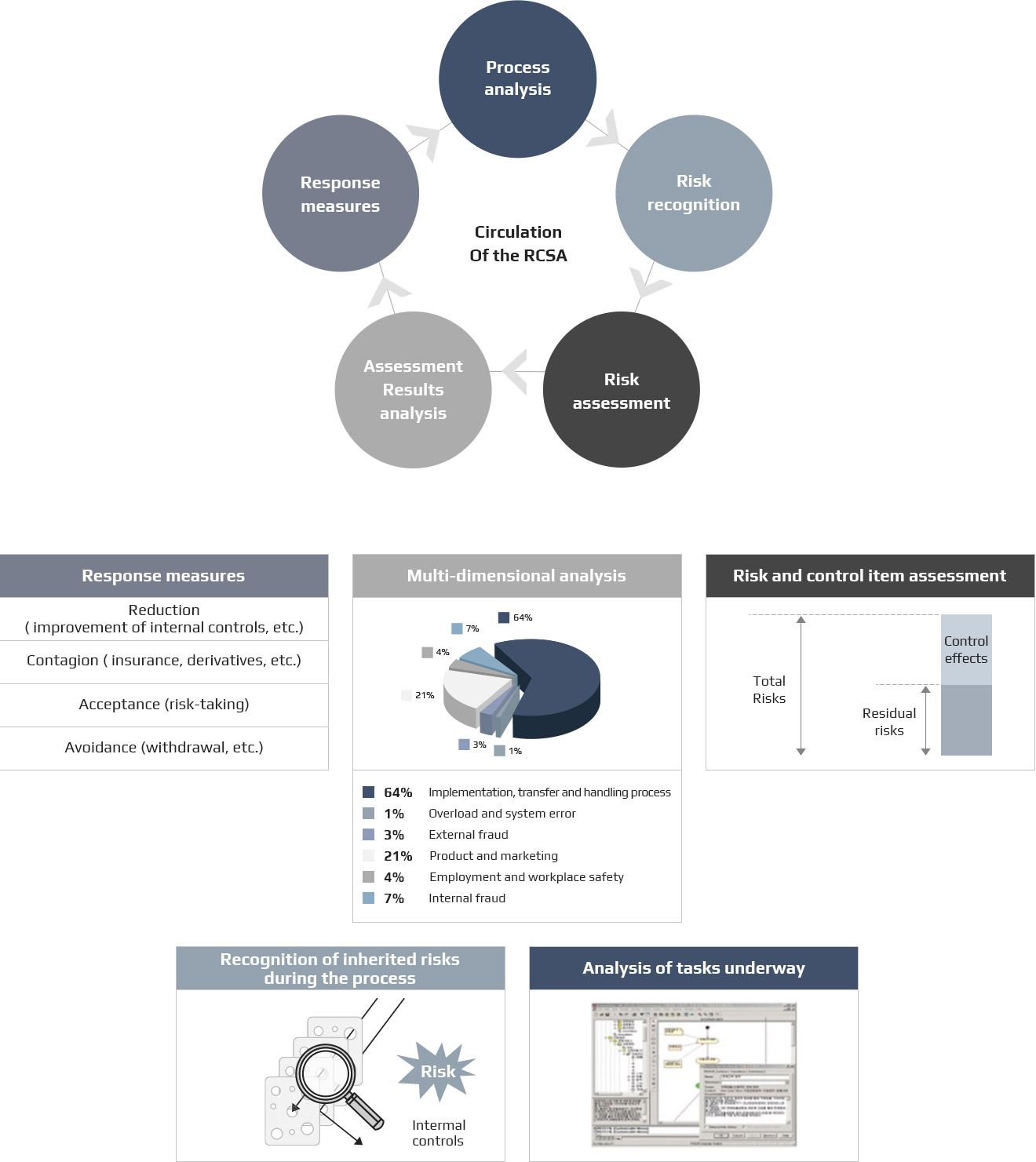

Risk and Control Self-Assessment(RCSA)

RRCSA is a series of activities for recognizing and assessing risk factors that can arise from the tasks under way and is a control mechanism for these Factors in order to come up with the appropriate response measures.

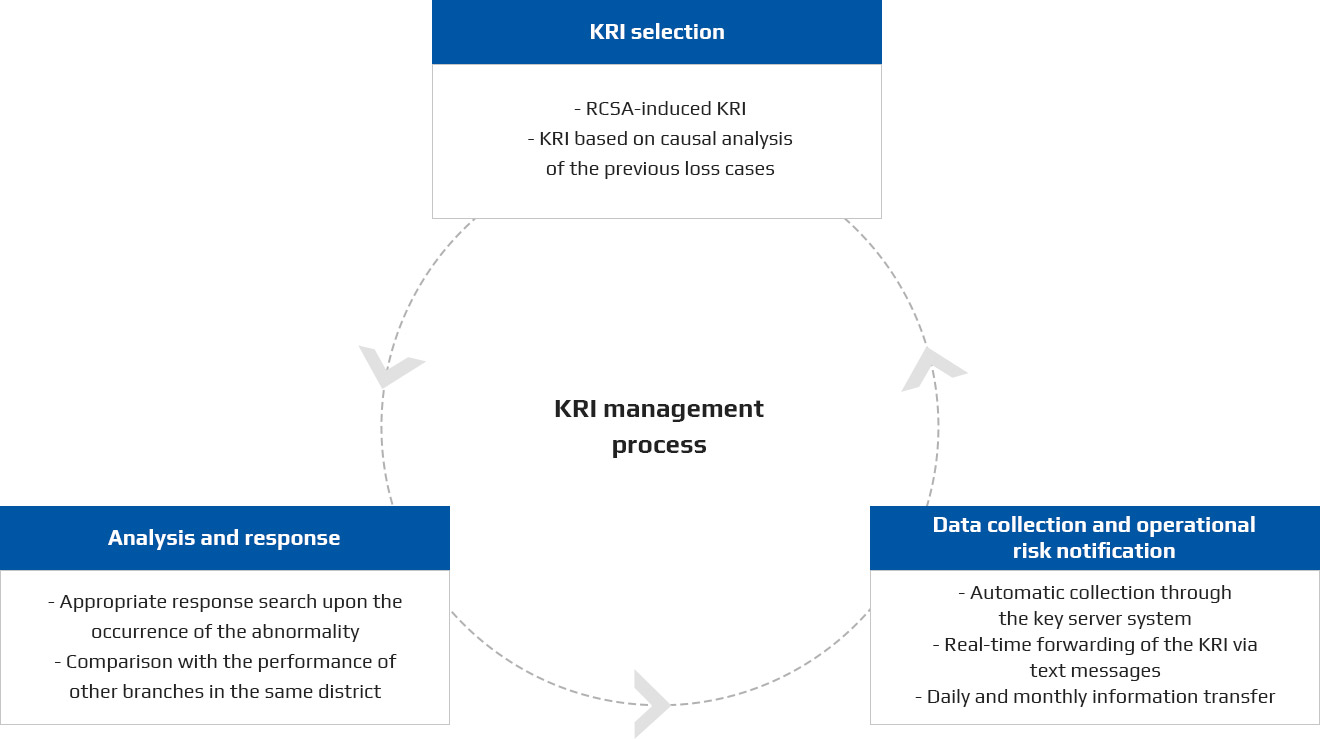

Key Risk Indicator (KRI)

KRI is a measured indicator that helps the user to recognize the probability of the occurrence of key operational risks in advance and allows them to respond in the early stages.

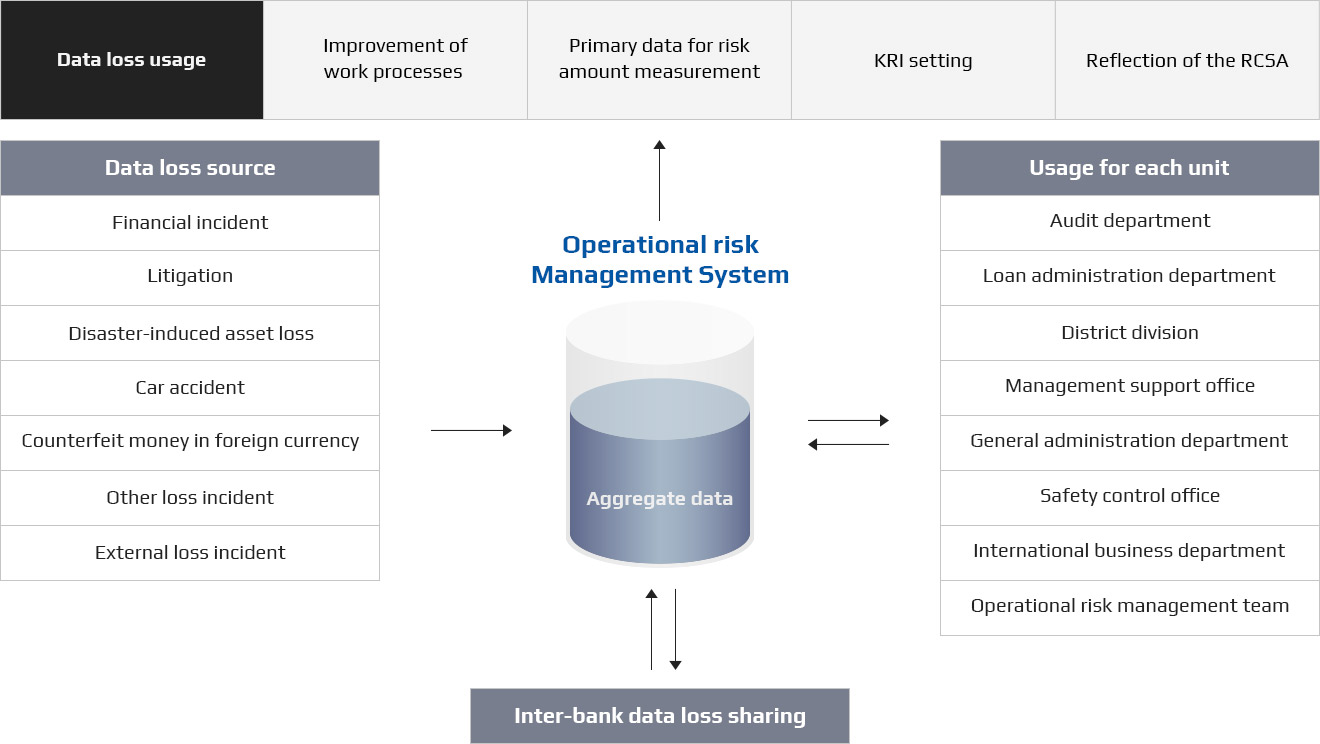

Data loss management

Data loss refers to information and data about all the loss incidents that is generated by people, work processes, the system and external factors(e.g. an employee’s embezzlement of customer deposits, or the loss of bank assets committed by a party , etc.)

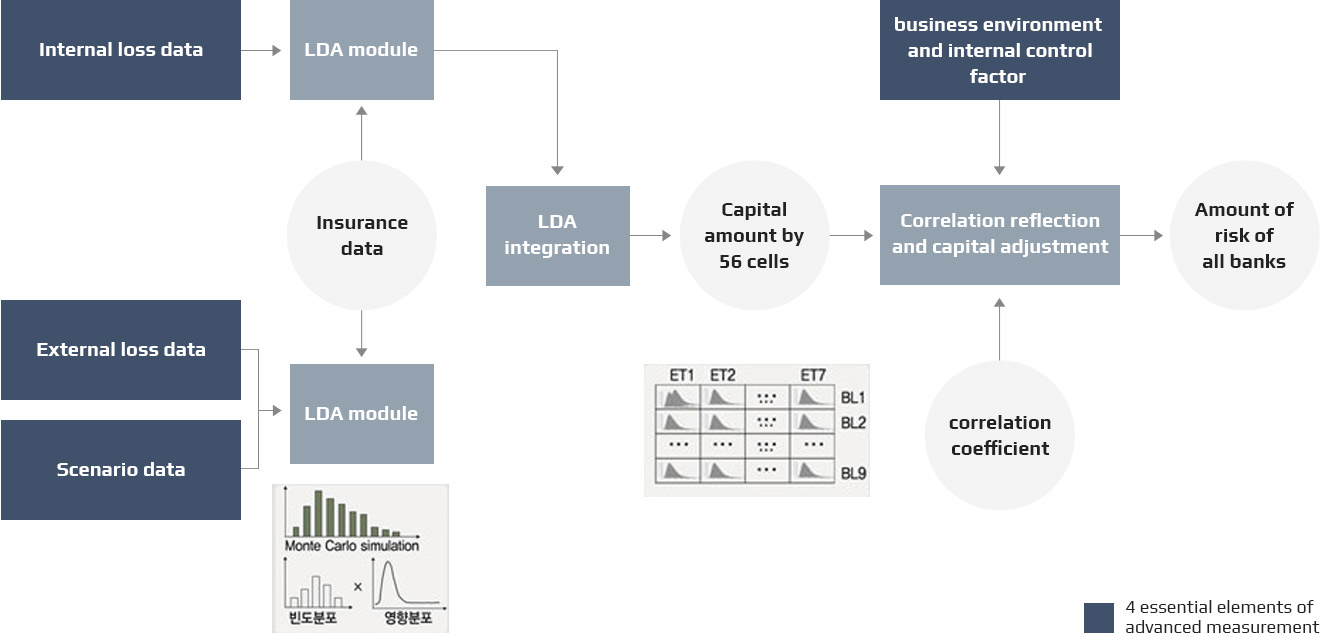

Operational Risk Measurement