Corporate Financial system

Corporate Financial System for Market Share and Operating Profit

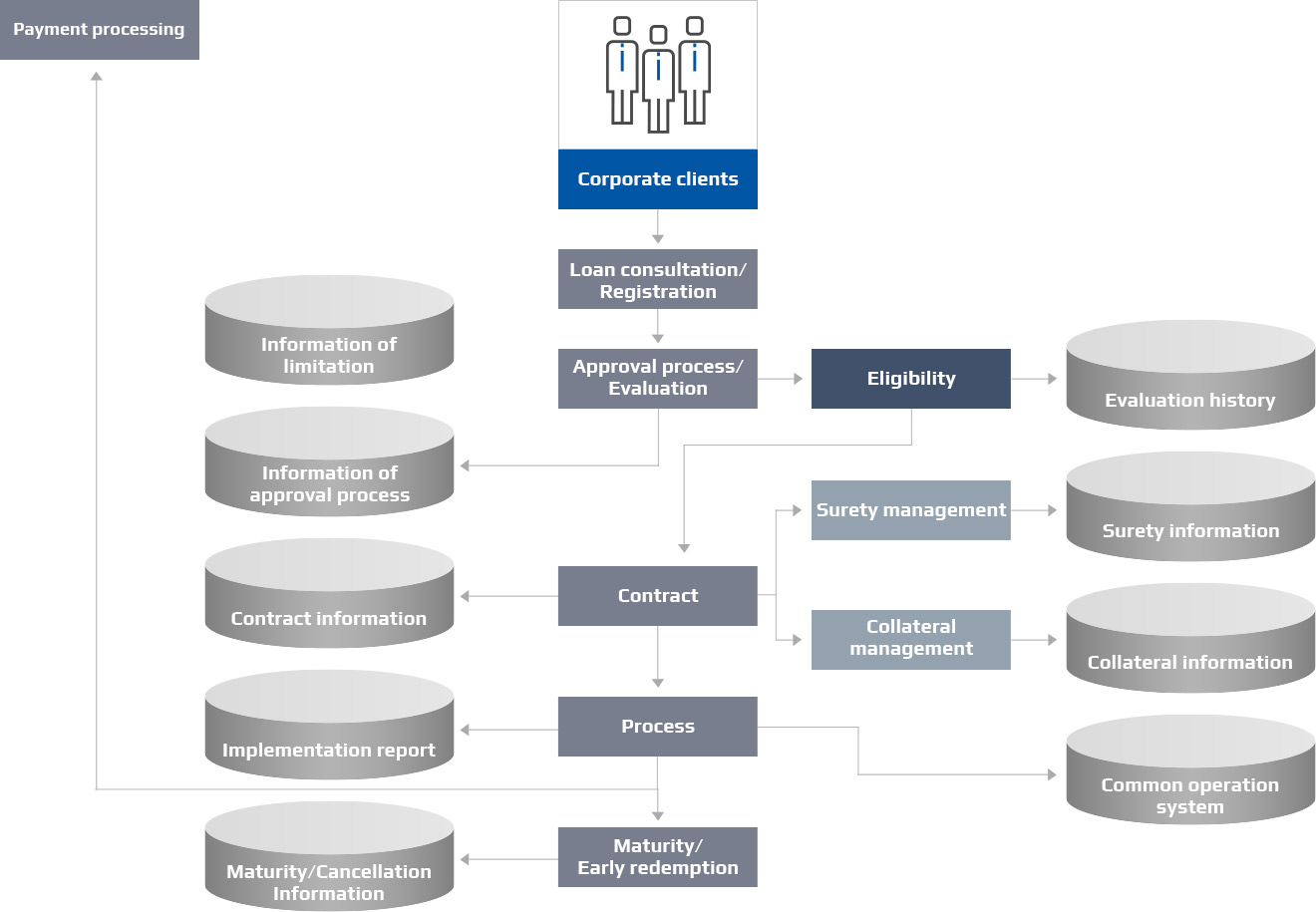

By establishing an advanced financial system by a group of experts in corporate finance, we will help clients maximize their market share and operating profit. We suggest optimal products based on various corporate products that are essential for operations. Moreover, it is a service that offers loans to operating corporate after calculating the corporate's limit. Corporate loan management includes consultation, approval process, review, arrangement, implementation, and follow-up management.

System deployment scope

Corporate Financing Credit Management System

-

- Consultation service management

- Loan consultation services

- Preliminary review

- Credit information

- Credit limitation

-

- Approval process/Evaulation management

- Approval process and finalization of loan

- Collateral management

- Surety management

- deposit management

- credit limit management

- Approval process and finalization of loan

-

- Implementation management

- loan implementation

- Cancellation of loan implementation

- Finalization of loan schedule

- Loan acceptances

- Claims/Payments

-

- Follow-up management

- Collateral management

- Surety management

- Processing prepayments

- Cancellation process

Features and Advantages

The Nation’s Best Corporate Financing System

- Development by professional resourcesRich consultation of financial business and engagement of IT specialists

- System constructed based on business know-howSecuring safeness of system by 10-year development Know-how

- Design considering various product scalabilityA design considering product diversity and ease of development of new products

- Validated SystemA system operated and applied to numerous financial institutions

- embodiment of object-oriented JAVAEmbodiment of application utilizing object-oriented Java

- Web environment systemConvenient user-centered web environment system